20+ Debt payment formula

Amortization is the paying off of debt with a fixed repayment schedule in regular installments over a period of time for example with a mortgage or a car loan. To calculate a number of payment below formula is used.

How To Calculate Pv Of A Different Bond Type With Excel

Examples of annuities are regular deposits to a savings account monthly home mortgage payments monthly insurance payments and pension payments.

. Cost of Debt Post-tax Formula Total interest cost incurred 1. An individuals monthly debt payment compared to his or her monthly gross income. 20 100 120.

Now we have to calculate the EMI amount and interest component paid to the bank. Popularized in Senator Elizabeth Warrens book All Your Worth. 0005 6 annual rateexpressed as 006divided by 12 monthly payments per year.

Lowers your monthly payment. Your last loan payment will pay off the final amount remaining on your debt. If you have too much debt and too little income to pay off your student loans the Income-Based Repayment plan can help prevent default.

Paying 20 down payment considerably reduces your principal loan amount. So Kd Before -tax is. The mortgage principal is 400000.

This category can also include the minimum monthly payment on any debt you have undertaken. If the company fails to meet its Interest Payment continuously Lenders would worry about their capital. Whether your lender will require you to pay for private mortgage insurance PMI.

The down payment is usually one of the main limiting factors in home affordability. Monthly Debt Payments refer to monthly bills. Non-payment of debt obligations would adversely affect the overall creditworthiness Creditworthiness Creditworthiness is a measure.

For example after exactly 30 years or 360 monthly payments youll pay off a 30-year mortgage. A portion of each payment is for interest while the remaining amount is applied towards the. 1r 20 10001r 20.

A 50 30 20 budget refers to a formula for dividing up your after-tax income to help reach financial goals. Loan payment loan balance x annual interest rate 12 In this case your monthly interest-only payment for the loan above would be 6250. Knowing these calculations can also help you decide which loan type would be best based on the monthly payment amount.

To qualify for loan forgiveness you must make on-time payments for 20 years for loans disbursed after July 1. 100000 the amount of the loan r. A salaried person took home loan from a bank of 100000 at the rate of interest of 10 for a period of 20 years.

A DTI ratio of 20 means that 20 of the individuals monthly gross income is used to servicing monthly debt payments. Written by CFI Team. The term bond refers to a type of debt instrument that pays periodic interest in the form of coupons and such bonds are known as coupon bonds.

While this budget category includes food and utilities it excludes non. A lower loan amount directly decreases your monthly mortgage payments. Typically youll need PMI if you put down less than 20 of the homes purchase price.

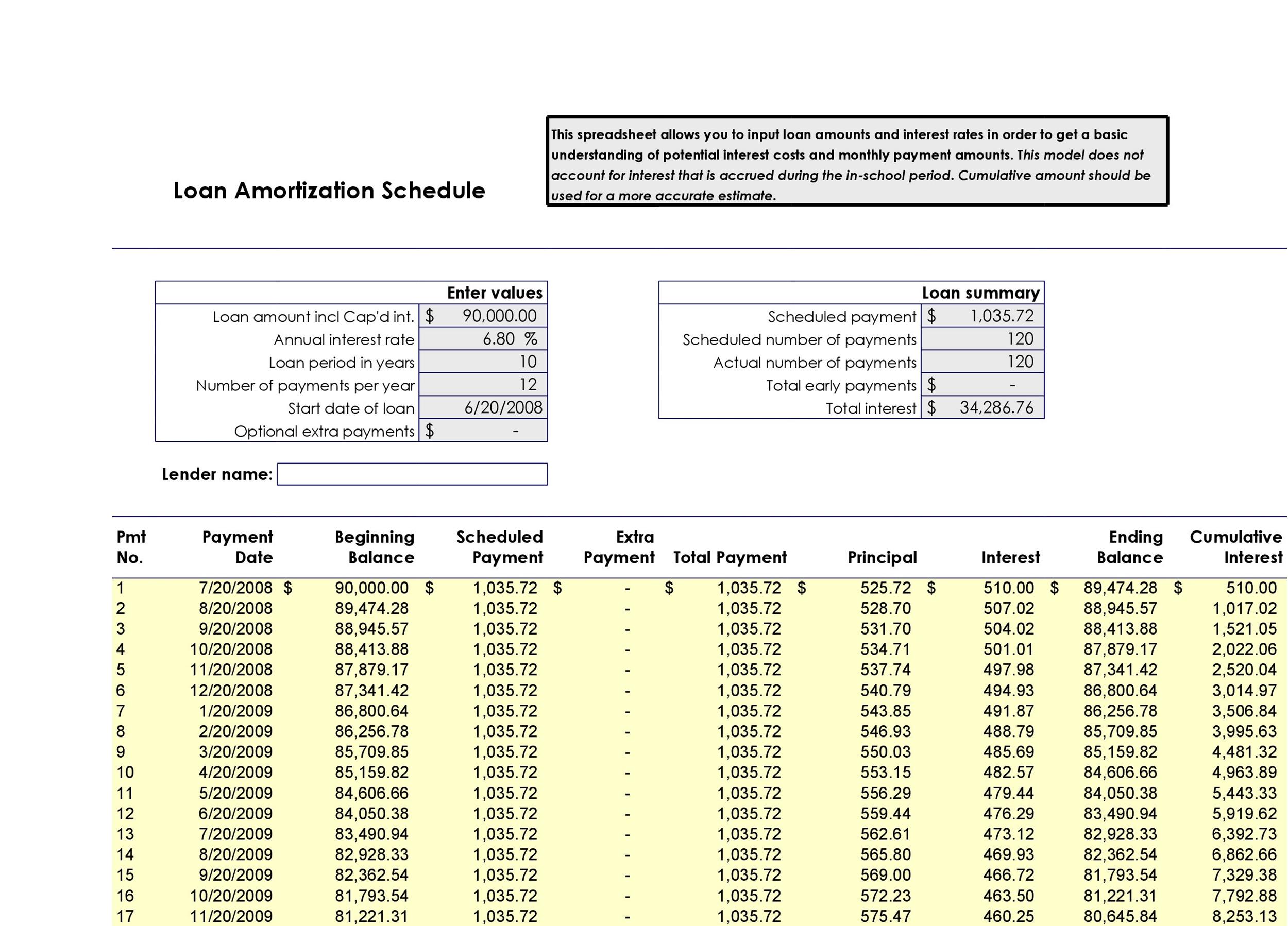

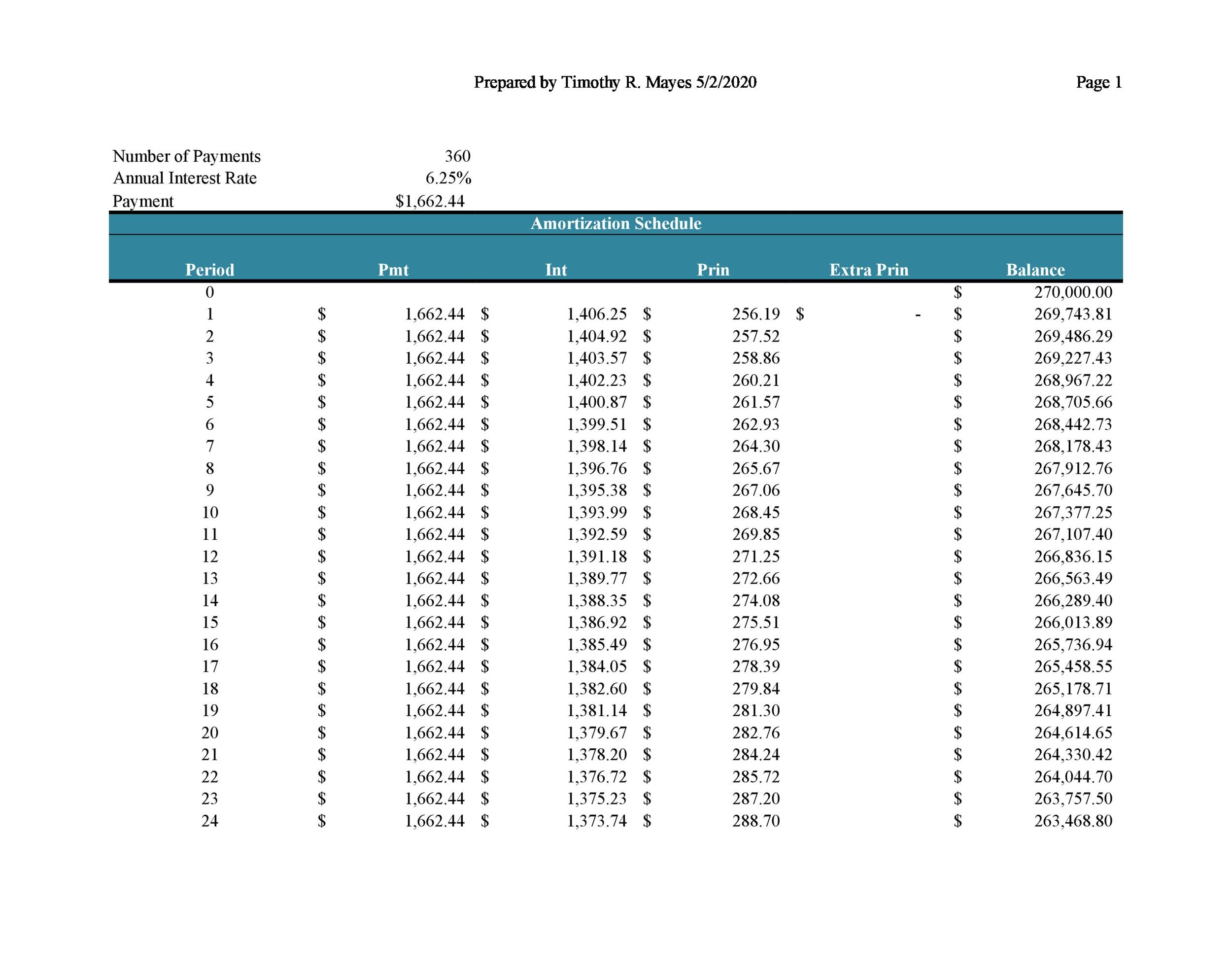

It also refers to the spreading out. If debtholders require a 10 return on their investment and shareholders require a 20 return then on average projects funded by the bag will have to return 15 to satisfy debt and equity. Amortization tables help you understand how a loan works and they can help you predict your outstanding balance or interest cost at any point in the future.

For example someone with 100000 cash can make a 20 down payment on a 500000 home but will need to borrow 400000 from the bank to complete the purchase. Annuities can be classified by the frequency of payment dates. Amortization refers to the process of paying off a debt often from a loan or mortgage over time through regular payments.

An amortization schedule is a table detailing each periodic payment on an amortizing loan typically a mortgage as generated by an amortization calculator. Here we discuss how to calculate Bond along with practical examples. The formula is Total Debt Total Capital.

There are also bonds that dont pay coupons but are issued at a lower price than their redeemable. Made with real chicken for quality protein added DHA to promote proper brain and vision development and omega-6 and omega-3 fatty acids for skin and coat this formula. Debt to Capital Ratio is a Solvency ratio that indicates how much of the companys capital is funded via Debt.

Updated July 30 2020. Required Salary to Qualify for a Mortgage Results. To calculate the monthly payment convert percentages to decimal format then follow the formula.

The payments deposits may be made weekly monthly quarterly yearly or at any other regular. Lets say Jason wishes to buy a car from a dealership. Kirkland Signature Natures Domain Puppy Chicken Pea Formula is formulated to meet the special nutritional needs of puppies and is also great for pregnant or nursing mothers.

The car costs 22000. Because your down payment represents your investment in the home your lender will often offer you a lower rate if you can make a higher down payment. So the spreadsheet allows you to adjust the minimum percentage.

Solving for the above formula using a financial calculator or excel we get r 364. NPERRatepmtpv To calculate cumulative interest payment for period n1 through n2. His bank approves a car loan which allows Jason to buy the car.

Formula for the Debt-to-Income Ratio. The c omponents of Equity Capital. An annuity is a series of payments made at equal intervals.

Other monthly debt payments. Here is the formula the lender uses to calculate your monthly payment. Youll need at least 20 down to avoid paying PMI but you may have a situation where it is okay to make a lower down payment.

The IBR plan not only bases your payment on your income but also promises loan forgiveness. Guide to Bond Formula.

The Ultimate Guide To Budgeting Weekly Paychecks Budgeting Paycheck Budgeting Worksheets

How Do You Calculate The Debt To Equity Ratio

Small Business Inventory Template Google Docs Google Sheets Excel Word Apple Numbers Apple Pages Pdf Template Net Excel Templates Small Business Expenses Printable

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

How To Invest In Yourself 26 Mostly Free Ways To Upgrade Your Life Self Improvement Self Improvement Tips Self

Have A Need For Financing Call Me Today To Discuss At 503 614 1808 Thebrokerlist Blog

7 Habits Of Debt Free People That Will Change Your Life Debt Free Budgeting Money Debt

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

Our Newest Infographic Showcasing The Global Finance Transformation Finance Business Infographic Infographic

How Do You Calculate The Debt To Equity Ratio

New York Lottery Predictions This Week Lottery Results Lottery Lottery Numbers

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

How To Calculate Pv Of A Different Bond Type With Excel

Foot Traffic Formula Email List Building Strategies Networking Quotes Fb Ads